Imagine a world where financial reports are delivered in real-time without your direct involvement and you stop working late nights, weekends, and during your family vacations?

As the CFO or Venture Capitalist of a Private Equity Fund, you may already have an ERP system in place. Most companies are running Netsuite, Great Plains, or possibly QuickBooks.

But, you could be planning to change your direction this year by moving to a newer ERP system. If that’s the case, why not choose a system that quickly delivers what stakeholders want and also gives you more time to spend with your spouse and children during the various weekend trips and vacations that get squandered when an investment firm requests a report at the last minute? It’s a win-win for you and your clients.

Maybe you’ve considered a change but don’t yet have it in the budget. With the many systems your organization is using, managers are experiencing avoidable headaches. Does that include you?

Are You?

- Struggling with consolidations and allocations on multiple funds?

- Still using Quickbooks logging into numerous instances each day — as if you’re an adult wearing children’s clothes?

- Frustrated with spreadsheets loaded with errors and mistakes?

How Do You Keep Up, Without Losing Your Soul?

As a company managing various funds, you have the complex task of creating reports, and quickly. The balance sheet tallies include incentive and management fees to the fund management costs. Unfortunately, in Quickbooks, these numbers must be manually tracked in a spreadsheet, consuming your highly paid people’s valuable time. And, when you have 35-40 funds, this becomes a nightmare, even if you’re willing to burn large stacks of money.

How do you keep up with contributions, distributions, co-investments, unique preferences, particular needs?

Your management company wants to receive reporting of the funds. How often do you give that to your clients? Is it once a year?

How will you ever hear that they tell their colleagues what a great job you are doing on their behalf?

What if you used an ERP Software that provides you the capacity to…

- Report key financial performance indicators weekly?

- Send weekly reports with a net asset value in practically real-time?

So many times, companies make considerable investments to build their software. Why? They are unaware that a solution already exists to resolve their problems.

What happens when a right-hand member of your staff goes on leave or vacation?

One client shared that when their right-hand person, who did everything, went on maternity leave, he didn’t know what to do. Then, he realized that it was a lot harder than he thought to keep up with everything for all their clients.

What was a beast to manage before became “completely unmanageable.”

But, this must be impossible, right?

That’s only possible for people who don’t have a life or a family… for those locked in the office?

How Many Weekends Are You Working or Vacations Have You Skipped to Generate Spreadsheet Reports?

How stressful and daunting is your work? Are you anticipating that next crunchtime project, the report you needed yesterday for the top-level management company lending you millions of dollars? Just like that?

How common is this story? You’re leaving for vacation this weekend, and you have to get all your work done before you go. So, you work 90 hours starting on Monday because you want to get everything done so you can take off. But, then Friday comes, and the managing director calls requesting a new last-minute report for Johnny at Goldman Sachs. As you look at the spreadsheet before you, you realize your vacation just got canceled, you’ll be working through Sunday night, and now you have to be the “bad cop” to your spouse and kids.

What If….?

What if we could show you a system where all you do is press a button, and you never have to work another weekend in your life?

Is that worth exploring?

No more working weekends while you miss your kid’s ballgames, time with your spouse, and vacations!

When large funds entrust you with money to manage, and they say they want this reporting, net asset value fund investments, at least quarterly, and you can’t deliver it, they get agitated. They are known to board a plane, meet you where you are, and harass you until you make it happen.

Your client demands excellent financial reporting, but when you hand them a cobbled-together spreadsheet, that isn’t going to be good enough to keep them happy and coming back to you. The reports you present to your client need to look world-class like they come from sophisticated software.

Your Product is the Yield You Give Your Investors

Do you know… What is your product?

Let us help. You manage funds. Fund owners will put their money where the yield is most substantial. There are many Private Equity Firms out there. What is going to make your product (yield report) stand apart?

It’s the packaging.

Consider how your reports look to your clients. For example, are you delivering your reports wrapped in a newspaper (Excel)? If so, your company’s value is under-presented, and under-presented value diminishes the perception of what you do.

Don’t you think that the business owners entrusting you with a billion dollars to manage for them deserve to have your product presented in a wrapper more valuable than a newspaper?

The Four Seasons Hotels and Chick-fil-A are two world-class service organizations. How about an Apple iPhone where the box is just as impressive as the phone?

What if you could save hundreds of hours and that savings could be transferred to your overall operating cost? What if that savings meant you could generate real-time reports? And what if, that report could be delivered in a way that’s reflective of the impressive work done by you and your team?

Sage Intacct Is An Excellent Wrapping — Trusted CFO Solutions is the Right Partner

There are multiple accounting firms like Trusted CFO Solutions that work with Sage Intacct. Many Sage Intacct partnerships will sell you the software, and that’s it.

Choosing Trusted CFO Solutions is choosing a company that understands your situation, your business, and your industry.

You can outsource your accounting to Trusted CFO Solutions. Or, you can hire us to help you set up Sage Intacct and support your internal accounting team who will use it. The team at Trusted CFO Solutions is apprised of accountants and entrepreneurs who do the implementation, hold your hand through the process, and answer your questions. That’s what we do here!

We understand your business and are ready to serve you. While engaged, you call us whenever you need to with your issues, and we get them fixed.

How is QuickBooks Working For You?

Let’s say you have 35 funds and their subsidiaries. In Quickbooks, you have to log in to 35 different companies every day to check cash balances and then plug the numbers into a spreadsheet to calculate them. How many hours are you spending logging in and out and transferring numbers to spreadsheets, which by the way, leaves room for significant error?

What happens when you IMMEDIATELY need those reports for the fund owners? There is no reporting in QuickBooks.

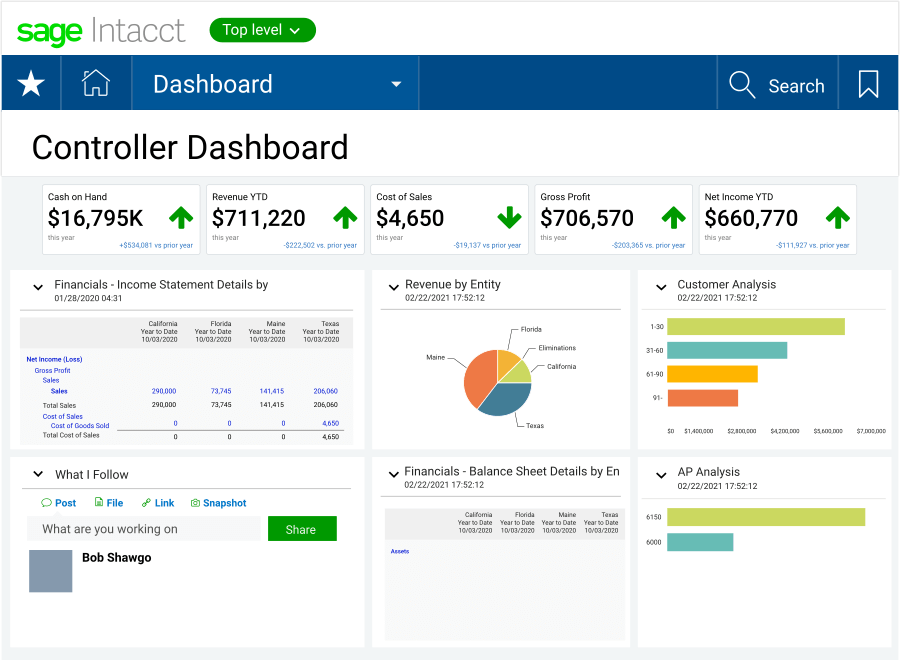

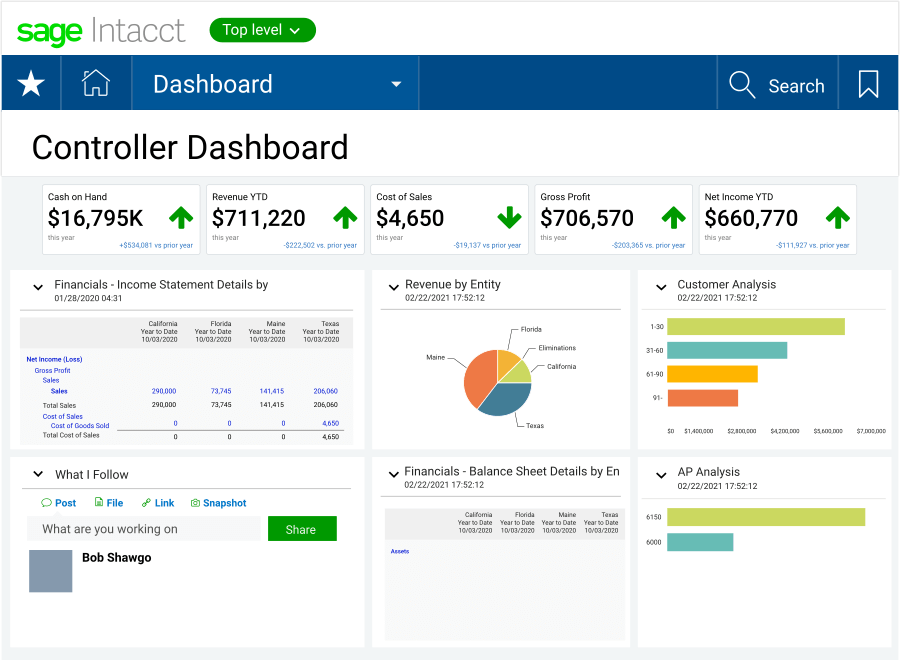

But you do have other options available that do provide reports. Sage Intacct dashboards are what CEOs have been asking for years.

It’s time to get out of Excel spreadsheets and have what you need so your boss no longer comes down on you. Then, when you have what he asks for, you are finally free.

What Makes Sage Intacct ERP Different?

Sage Intacct dashboards are what CEOs have been asking for years. This financial management solution is:

- The number one in customer satisfaction

- Able to consolidate 100s of entities in seconds

- The AICPA preferred financial management solution

- A Salesforce Platinum ISV Partner

It’s time to say goodbye to Excel spreadsheets and hello to the reporting you need so your boss no longer comes down on you. When you have what he asks for, you are free to take your family time, weekends, and vacations back.

For a deeper dive into Why Sage Intacct ERP is different, click here.

What Else? What Value Does Trusted CFO Solutions Deliver for Private Equity Firms?

We provide fully customized dashboards giving you advanced financial reporting for management and limited partners allowing management to perform continuous real-time consolidations and automation of multi-entity and inter-company transactions.

What we provide eliminates errors caused by manual projects done in Excel and allows finance and accounting teams to collaborate creating a robust audit trail for auditors.

Our team at Trusted CFO Solutions is here to help you rationalize your back office, get away from using spreadsheets, and give your weekends back to you.

To take the next step or learn more book your 30-minute complimentary consultation.

About The Author

About The Author

Mark is an accountant at Trusted CFO Solutions who “combines his intellect with a very astute knowledge of the capital markets to deliver a winning combination to any business venture.”

>> Connect with Mark on Linkedin here.

About The Author

About The Author