Sage Intacct Users: Is Your Business in Compliance for CARES Act Forgiveness?

At Trusted CFO Solutions, we are here to help save businesses during the COVID-19 Pandemic so they can all emerge stronger.

The Trusted CFO Solutions team applied for 22 million+ for our clients within a month after the CARES Act became law. And we have a goal of applying for 75 million by the end of May. But, is applying and receiving the funds all a business needs to ensure forgiveness?

Loan forgiveness indicates the funds are non-reimbursable (don’t have to pay back). That is good news for business owners. However, within the CARES Act law, there is a required compliance directive to ensure forgiveness of the expenditures, and the tracking of the use of funds is critical to have them forgiven. If you don’t comply with the loan covenants, it will turn into a loan that does need to be paid back.

The team at Trusted CFO Solutions wants to help our clients and others benefit who currently use Sage Intacct. We are sharing our advice on how to configure the system to track the usage of those funds. Those utilizing Sage Intacct can easily incorporate a project dimension that tracks expenses related to COVID-19. This dimension provides ease in reporting back to the SBA for loan forgiveness and allows for internal expense tracking.

There are three preliminary items to implement related to the PPP SBA 7(a) accounting and audit setup in Sage Intacct.

- Open a new bank account (or repurpose an unused one) to deposit all PPP funds from the SBA – avoid co-mingling funds (Your System Admin will need to do this).

2. Set up a new balance sheet account to keep track of the PPP loan.

3. Keep track of all inflows and outflows to/from the account and reconcile monthly for a clean audit trail to support debt forgiveness in 3Q – using Sage Intacct Projects – Standard Dimension (There is a step by step outline below to add this dimension).

Within the COVID-19 Project dimension there are three types of costs:

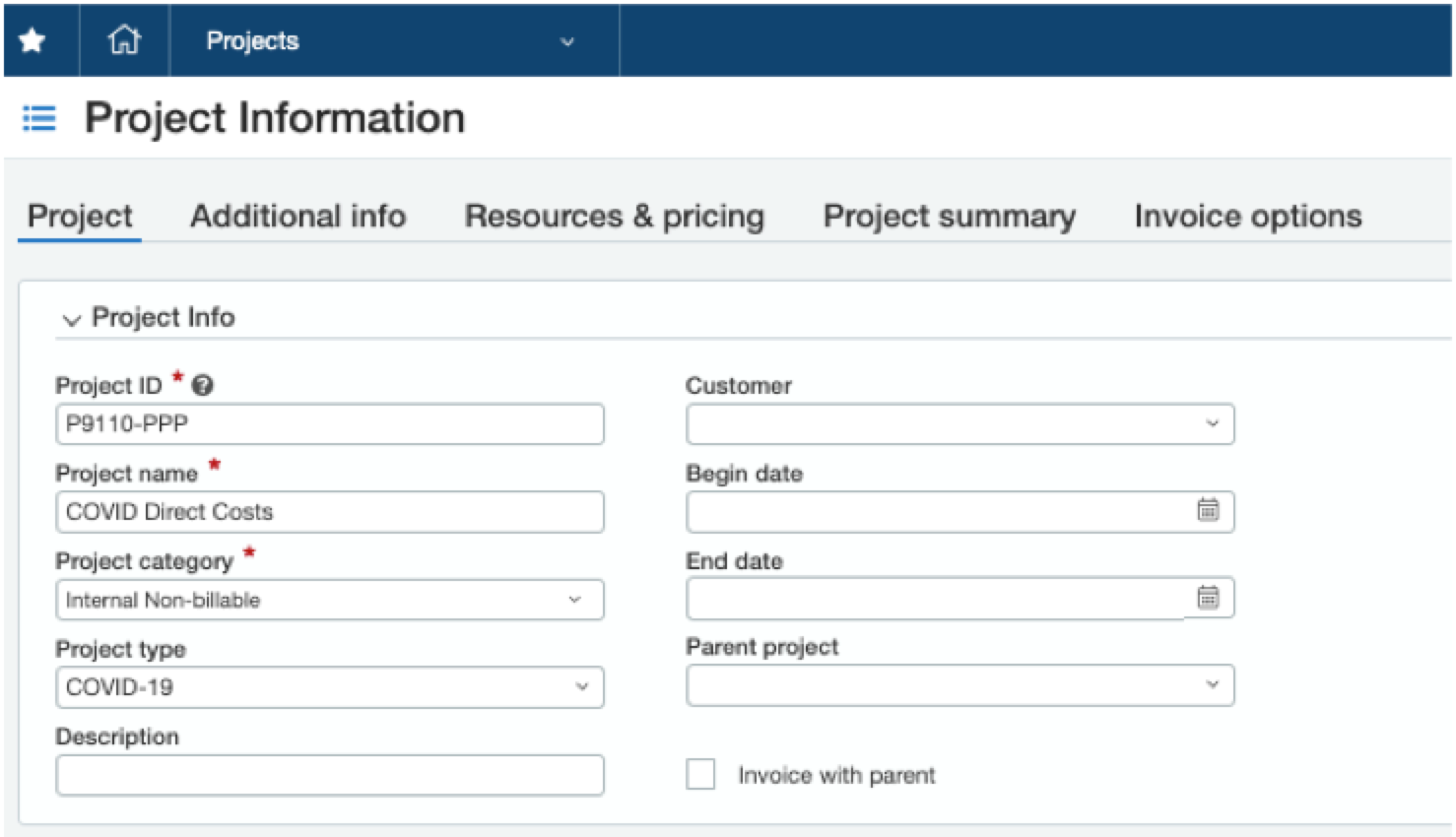

- COVID-19 Direct Costs: (hard undisputable costs related to Corona crisis) accumulate hard-dollar, direct costs related to employee lay-offs, safety costs, re-forecasting and scenario analysis costs, cost of refinancing, etc.

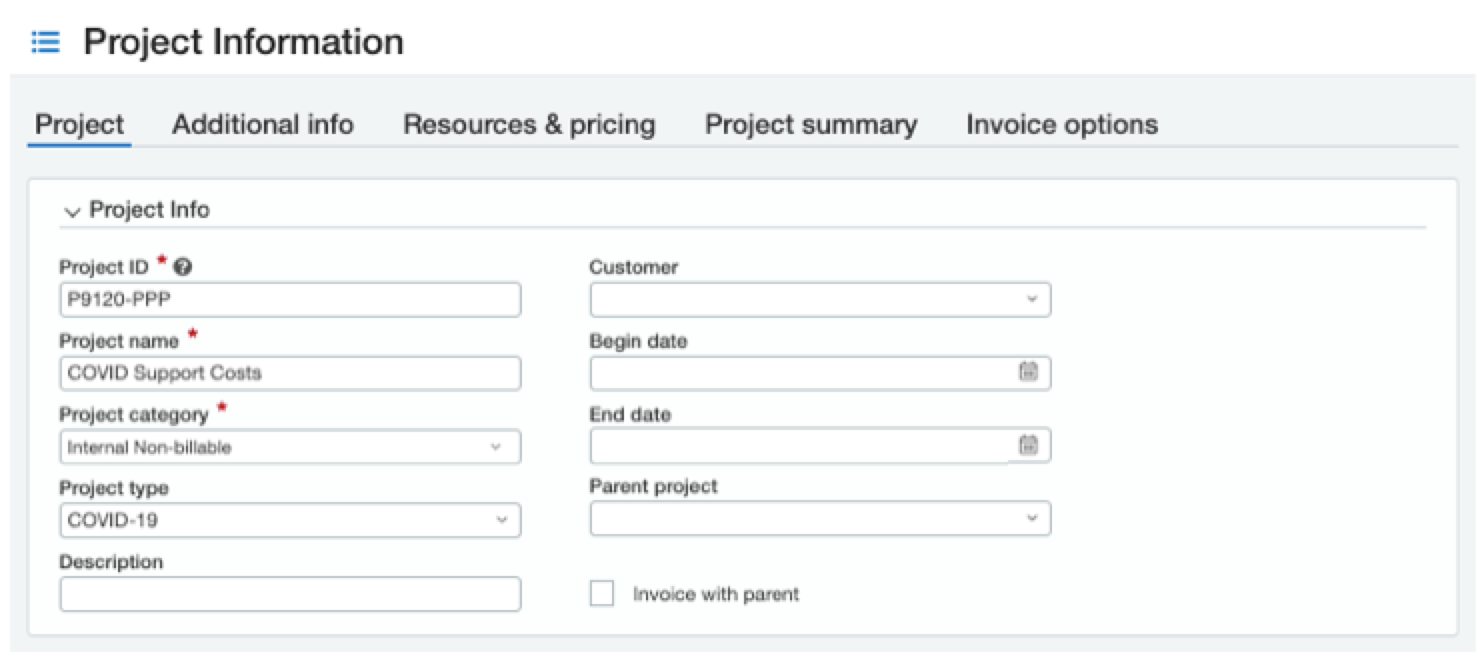

- COVID-19 Support Costs: (softer costs) capture discrete costs to support modifying a company’s approach to business to operate through the crisis (e.g. production/delivery process automation, refurbishing during downtime, discounts to collect AR, expedite fees on inventory, bad debt, etc.)

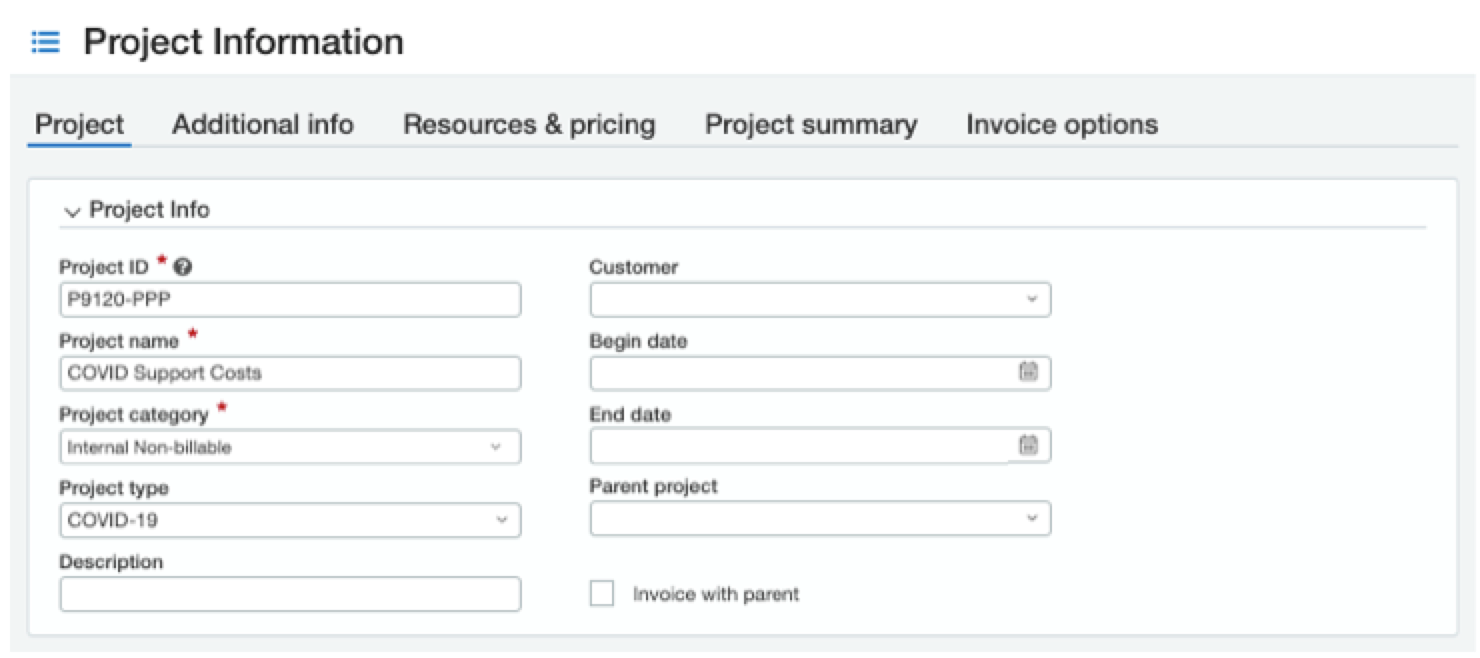

- COVID-19 Indirect Costs: (softest costs that are most debatable) accumulate costs that represent time and energy spent on the Coronavirus crisis (e.g. allocate time of people, including the CEO’s time, to Coronavirus issues, rent when you don’t need facilities, support staff kept when not needed, time spent on PPP, etc.)

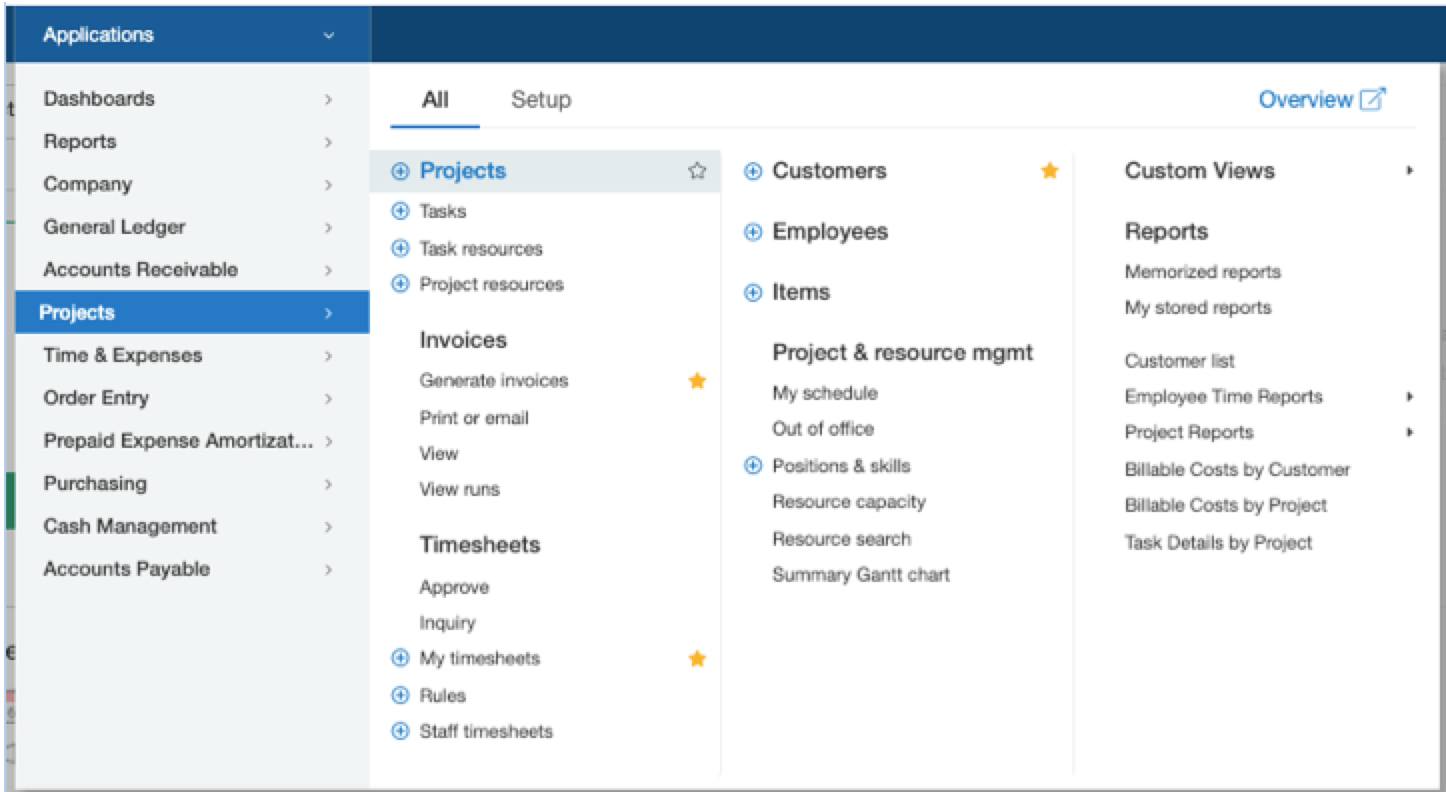

To help Sage Intacct users maximize time, we include below an outline of the steps to add a Project.

How To Add A Project Dimension

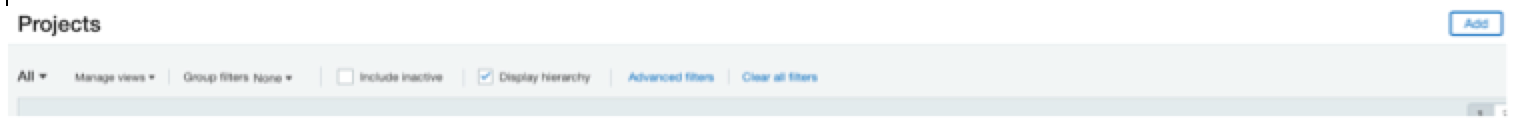

Navigate To Projects > Projects

Click Add

Enter The Project Information Shown Below

The TCFOS Task Force’s mission is to help businesses emerge stronger!

If you need help on what to do, click here to set up a time!

Note: This is a new bill. While we understand the bill and what’s in it. The implementation by the government and banks may change. The information above may update in the coming days.

Share This Blog Post On Social Media Using the Following Graphics

Tags

Outgrowing Quickbooks?

Say goodbye to spreadsheet reporting and manual consolidations and start using a cloud-based financial management system.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.