Webinar: “How The Third Financial Statement Is A Restaurant’s Secret To Success”

What Is The GRA?

The mission of the Georgia Restaurant Association is to serve as the voice of Georgia’s restaurants in Advocacy, Education, and Awareness.

The Georgia Restaurant Association (GRA) has operated as the voice for Georgia restaurants since 1906. They have very limited knowledge of the association’s activities until 1972, when under the leadership of Marge McDonald the GRA joined with the Georgia Travel, and Georgia Hotel and Lodging Association, which then fell under the umbrella of the Georgia Hospitality & Travel Association (GHTA) as its food service division (GRA) to merge the three organizations into one at that time.

What Is The Webinar About?

Many restaurant owners & managers believe their business is performing well and making a profit contrary to industry evidence.

Poor financial management prevents owners from making payroll and routinely result in restaurants shutting down. What are they doing wrong? They’re missing the secret to operating a financially sound restaurant through their third financial statement.

In this webinar, Dixie McCurley reveals the third financial statement and shares with you why it is so critical to managing and growing your business.

Listen To This Webinar

Follow along with the slides using the transcript or presentation file listed below.

About Dixie McCurley

Never able to fully identify with the stuffy title of “accountant”, Dixie set out to revolutionize accounting practices for small- to medium-sized businesses by offering a new way of thinking about the process. Learn More…

Webinar Transcription

Okay, we are good to go. For those of you looking at the screen, we are going to go ahead and get started and I will turn it over to Dixie to present.

Dixie McCurley – Presenter

Good afternoon everyone, I’m Dixie McCurley with Trusted CFO Solutions, and I’m here today to talk about the Third Financial statement, what is The Third Financial Statement and why is it kept a secret from all restaurant managers and restaurant owners?

Most of you know a lot about the P&L and the balance statement. However, the Third Financial statement is sometimes a mystery and for me and it is the key to success. Today I want to be able to teach you a little bit about the Third Financial Statement and the three why’s of why you should be using it.

So, we are going to save questions to the end. As we go through the slides, you can type your questions in the box, and we will answer them near the end.

Who Uses The Third Financial Statement?

So, who is the number one user of The Third Financial Statement? In my preparation for this webinar, I asked a few CFO’s and also some investors, very sophisticated investors, which one of the financial statements are their favorites and the one they rely on the most. It was the third one.

Most of the reason why is because they want to watch the cash grow.

Lots of new restaurant owners and managers who turn into restaurant owners, sometimes spend their life savings to create and develop restaurant concepts. So, when you start a restaurant, you can spend 250k on it, and you can also spend up to a million. How will you be able to watch that money grow? How will you know you are on track, that you didn’t have a better chance with your 401-K, or if you should have invested in real estate versus the restaurant business? That is what I want to share with you today; it’s how investors watch their cash grow and how they use the third financial statement to be able to do that.

Another thing that investors demand is that their investment is secure. If they upfront the money for a restaurant of a $1M or $250M, they want to know it’s secure, that it will multiply, and that they will get a return on their investment that they couldn’t t somewhere else. The multiplication factor is very significant for them.

They also want to know when will they get their money back.

The spouses of restaurant owners and managers are the ones who are asking, “I know that we spent our life savings on this restaurant, how can we get it back?” That is what I want to talk to you about today, and that’s why I want to help teach you to how to use the third financial statement to answer that question of, “When will you get your money back from the business?”

Related to the employee, I am assuming that we have with us restaurant managers or restaurant employees, but also those managers who have started a business and are self-employed and maybe own their restaurant. When those people are successful, they turn into multiple restaurant owners, and that’s where I call that the business owner. You can’t run it like you are self-employed anymore. You have to run it as a business owner would run it.

The primary point for today of why to use the third financial statement is that I want to encourage all of you to think like an investor. So, if you learn nothing from me today except for what the third financial statement is and how investors use it, that is what I want you to gain. Please start thinking like an investor, making sure your money is growing, making sure the money you invest is growing, and making sure that the value is always there. So many restaurants start with an enormous amount of capital upfront that disappears, and they close within six or twelve months. Those are the pitfalls of not having a plan of action and not knowing what the Third Financial statement is.

Now we have covered who uses the third financial statement the most. It’s the investors, the CFO’s and the banks. However, what is it?

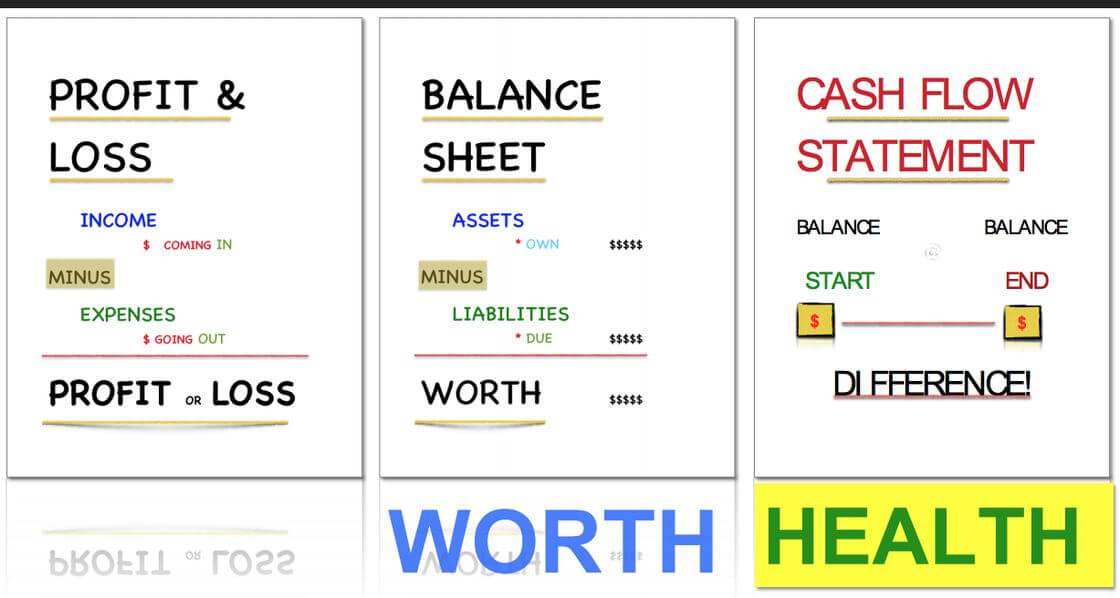

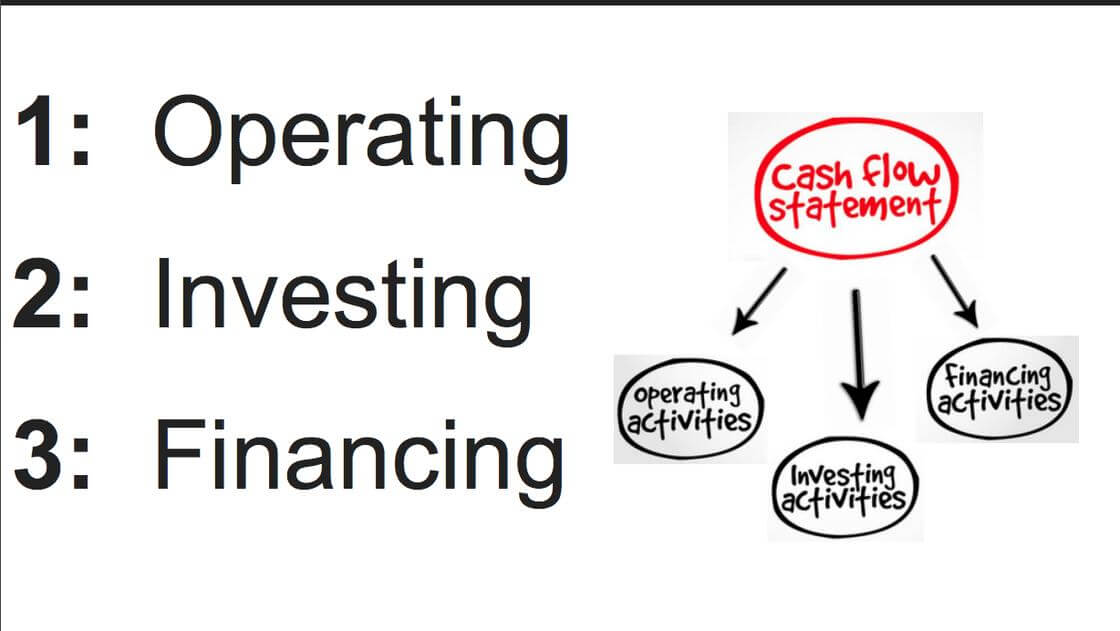

The third financial statement is one of three.

The Profit & Loss Statement

The first one is the profit and loss statement. I am impressed over and over again by the restaurant managers and restaurant owners ability to run a proper profit and loss statement. You all know what total controllable income should be. You all usually understand when customers use too much of your toilet paper because you know those purchases on supplies are too high. Alternatively, you know how to run inventory or your payroll costs. What about a bartender? If you have two bartenders that the sales don’t support it, you know how to let those people go home. You see that level of operational activity on a profit and loss statement. The profit and loss statement talks about all the money coming in. That’s the income in your business. Then, if you deduct from that your expenses, your food costs, and expenses that you are paying for, that equals for profit and loss. That is your first financial statement.

The Balance Sheet

Next, in accounting terms, is the balance sheet. That is the second financial statement. Accountants always want to make sure that the balance sheet is accurate. That’s how we know your assets are all there. That’s how we know how much you owe everyone related to the liabilities. In addition to that, the equities section is usually somewhat of a puzzle to the restaurant managers and restaurant owners. What do retained earnings mean? Is it worth as much as that initial investment? So, if your restaurant is two years old and you funded it with half of a million dollars, is it still worth a half of a million or is it now worth a million dollars? That’s what your balance sheet is going to tell you. It’s going to tell you what you owe more than you own or that you own more than you owe. So knowing the worth of the business is very important.

The Cash Flow Statement

As important as a profit and loss statement is and as important as a balance sheet is, the third financial statement is where investors say is the most important statement. That’s the cash flow statement. The cash flow statement takes the cash in the door and tells you where it used. Has it been used to buy inventory, to acquire fixed assets, or to cover payroll? How has that money been used? That is what the cash flow tells us. It predicts shortfalls in funding. So let’s say payroll is due on Friday and it’s 10k, but you only have 5k in the bank. That is a 5k shortfall in cash. To survive, you’ve got to know what your cash requirements are, knowing that your shortages are going to hit. Think about the profit and loss statement and how restaurant managers and owners know the profit and loss really, really, really well. Even profitable businesses go bankrupt every day. Profitable restaurants do, too because they may not predict shortfalls in cash. So, that’s what I’m here to teach you about today, the third financial statement. Since the balance sheet tells you what your business is worth, you always want to guard that and make sure that it’s worth what you put into it and that it’s growing.

Then the cash flow is where you want to see the health of the business. So let’s say you have cash needs or you have cash requirements that mean you have to go to an outside investor or an outside banker. That’s one of the first statements that will be used to see the health of the business. How is the business performing? What does the cash say concerning throwing off or consuming cash? Related to the cash flow statements, I’ve already mentioned that it’s the inflows and the outflows of cash. When you are an investor, you want to make sure you get your money back.

I’m a big fan of Shark Tank. When people come to the investors in Shark Tank, one of the first things they all say is, “When will I get my money back?” I want to make sure that I’m going to get my money back. That’s where you have to make sure the operations in your business are generating enough money to fund that payback. So, we’re going to look at and analyze at a very high-level today the cash flow statement. It’s the third financial statement that I would say 90% of restaurant managers or restaurant owners don’t ever look at or use. This next slide shows the three sections of the cash flow statement.

I’m going to try to keep it very high-level today. I will not try to dive into the all of the accounting speak related to amortization and those types of categories underneath these categories. I want to explain to you just the three high-level sections of what all of these mean for the restaurant that you’re operating.

The Operating Section

This section is where you can think about all your sells happen, all your banquet deposits and how you pay for your vendors when you buy inventory or operating expenses. These are all the sources you can think about going through your operating section, the very first part of the cash flow statement. So, I relate the operating section to the run out of gas light on your vehicle. If your light comes on and says, you are almost out of gas and have 17 miles until your tank is empty and you know you have 21 miles to your nearest gas station; you’ve got a problem. What are you going to do? You’re going to slow down. You’re going to try to extend the life of your gas. That’s where we see the first step in helping to control cash where there is a shortage that’s pushing AP Vendor payments. If an investor sees that your AP Vendor payments have been pushed and you have to call all your vendors and say, “I know all this money is due in 30 days, but can you give me 45 days?” When you can predict that, and when you can talk to your vendors about it, that’s when they’re going to extend those terms to you. That’s how you can help manage the cash flow of your business.

The Investing Section

The investing section can be a little bit confusing regarding me using the word investor. The investing section is where I want you to think about the equipment you purchased. So, think about the refrigerators, the fryers, the stuff that you use in your business that is equipment or fixed assets, that is what the investing section is all about.

An investor knows sometimes you may not have a healthy cash position because you just sold off several assets. That increases your cash. That could be a source of inflow of cash. Cash can go up if you sell off a piece of equipment. That’s another way to help manage your cash flow when you need cash flow. Instead of going to lenders, or to the bank or instead of going to investors or other sources of capital, you might sell off some equipment. That could also help fund any shortfalls in the first section of your operating section.

So, now that we know the first section is the operating section, and the second one is investing, the third one is the financing.

The Financing Section

The financing section is where the investor money comes into the business. So when you initially open your business or restaurant, any cash flow from those investors or loan proceeds from a bank goes through the financing section. Also as you use that cash, or if you pay out dividends, or you pay your loans down, it goes out through the financing section. So, what we see is that you could pay loan principals out of funds possibly not generated from the operating section, the first section. So your cash might be down. That’s where net income or profit doesn’t always equal cash in the bank.

Many times I see restaurants overextended on their loans. They have too much equipment, too many loans, and can’t pay the principal down. So, that line of credit sits maxed out. It will be in the financing section that you’re able to pay it out versus if you’re paying interest on that. Those are the three different sections of the cash flow statement, and most restaurant managers focus on number one, Operations. So, I want to teach you about why not only the P & L and the Balance sheet are two important financial statements but come up with three whys for you to use the cash flow statement. I want to keep it very high-level. I want to encourage all of you to make sure that your financials have the cash flow statement attached, or when you’re producing reports, you’re reviewing the cash flow statements every month.

3 Why’s

Return

Now, why should you as restaurant owners or restaurant managers care about the cash flow statement. To me, it’s really about the return on your investment, the return of your money, and the return of what the business is worth. Is it still worth as much as I put into it? The second why is about timing. Sometimes adjustments come from your tax accountant or CPA, where they want to reconcile the balance sheet. Those timing hits of amortization, depreciation, accrued expenses, the way that you book loans, and the way you spread out that income can make it very confusing to look at only the P&L or just the balance sheet and understand what’s happening with the cash position. So, once you get a handle on the P&L, the Balance Sheet and The Third Financial statement, the cash flow, that’s where you can start to use it. When you understand the three sections of the cash flow statement, and you start using it, that’s going to give you the ability to predict what you want to do with your business moving forward. Predictability is our third why and I’ll talk about that in just a minute.

Okay, we’re to the first why and it’s called return. Investors require a return of their money.

I would say that restaurant owners spouses want a return on their investment as well. When you put money into the business instead of into a 401k, shouldn’t you be earning a profit and how can you measure that? The cash flow statement is one area that you can be sure that you can pull money back out of the restaurant versus the money being gobbled up in operations.

So, the investors are looking at several different reports. The cash flow statement is usually the first one they review. What they care about is this business generating cash, is this restaurant making or losing money, and do we have the proper assets structured to produce best the sales needed. Those are the types of questions where investors are concerned. They want to see that your processes are sound, see the P&L, and moreover, they want to look at the cash flow statement. Investors predict growth and they are willing to give you more money if you can show them that you’re growing and that your operations are throwing off cash. It’s when you don’t need that it’s usually the very best time to ask them for more. Back to the Shark Tank analogy, they always tell the people in front of them, the people who want them to invest, that if they get lots of sales, they’ll fund the growth of the inventory. So they have to have big warehouses and build inventory to support that in their operations. Investors will help you for that build up. They will loan you money for that build-up to support the growth, but you have to be able to break it down for them. How much cash is operations throwing off, how much cash do you have in the investing section for your fixed assets and equipment, and then how much do you have from investors in the financing section? How much have you given back through dividends to your investors? That’s the rule of the cash flow statement. That was the first why you want a return from your business. You want to monitor it and make sure you will get a return.

Timing

The second why is about timing. The difference of the timing is that the cash flow statement reconciles or connects the dots between the P&L, the profit & loss statement, and the balance sheet. So related to if you’re making a profit or if you have cash; I cannot tell you an exact percentage by probably 75% of the business I have spoken to in my career, might have a profit but don’t have their hands around cash. It is because of the way cash flow is missing. Because of timing issues and the way things get booked due to accounting rules, you’ve got to use a cash flow statement to thoroughly understand the cash in and cash out of the business.

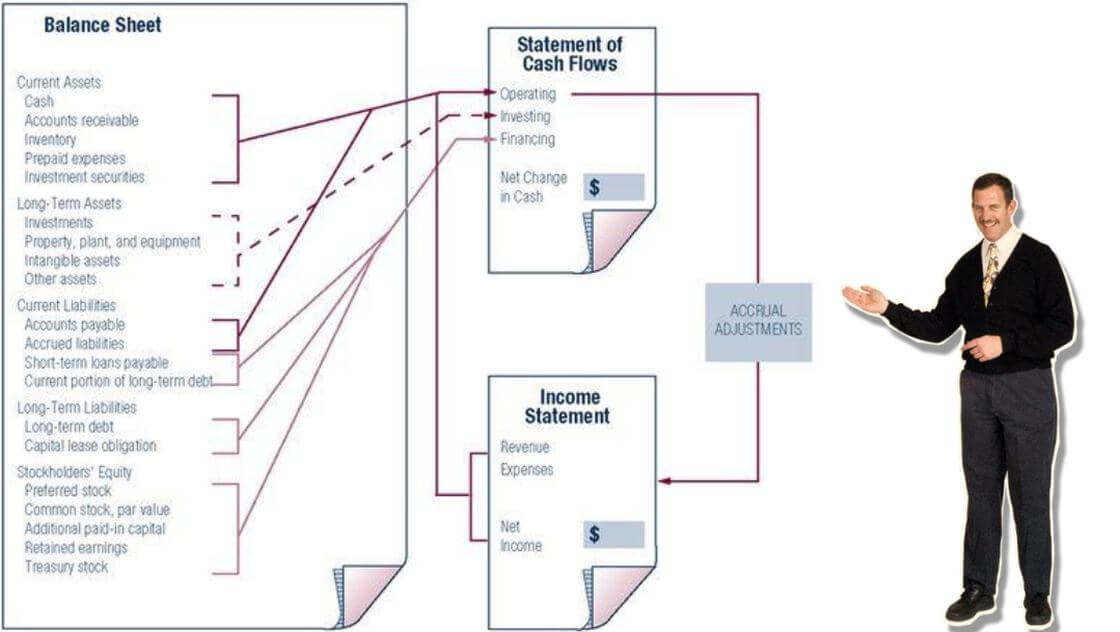

So, this is as detailed as I’m going to get today related to the lower level underneath these financial statements. I want to talk through about how the balance sheet is used to create the cash flow statement.

The equipment section as you can see on the left has the dotted line flows right into the investing section. So, accountants look at periods of time and measure it to come up with a statement of cash flow. However, as restaurant managers and restaurant owners, look at the trends of those things, the trends of the operating section. Has it gone up? Has cash gone up in the operating section? If so, that’s an excellent thing. It means your business is generating cash.

Now, what about the investing section? Is it going up or is it going down? That’s very important, and so is the financing section. Have you had to get more funding from investors? Have you had to put more money into the business personally? Have you had to get loans from banks? Are you having to increase the financing section because maybe your operations are draining it?

Those three sections are what can help you predict the health of your business in the cash flow statement. So, the accountant makes accruals to make sure the balance sheet balances are accurate. They look at your bank statements to make sure the bank balance is right. They look at your loan statements to make sure your liability section is correct. They look at your fixed assets to make sure they have appropriately depreciated. So, they make sure the balance sheet is right and then they report on the cash that came into and out of the business. That’s what accountants do, in general.

Before 1988 the cash flow statement didn’t even exist. So, why was it created? Well, because business owners, business professionals, and professional investors demanded it. They commanded from the accounting standards board that we wanted to see the cash inflows clearly, where the cash came into the business and cash went out of the business without having to look at all the bank accounts. So, they developed the cash flow statement, and now it is the Third Financial Statement. You want to include it in all of your month-end close packages.

For me, I would not say I like it when I have to tell a client about accrual adjustment, and they don’t understand because I’ve talked to them in accounting speak. It’s sometimes like going blah, blah, blah. So, I want to make sure that I’m very clear today. If you have questions related to any of those sections in the cash flow statement or questions about how the cash flow statement connects the P&L and Balance Sheet, please go ahead and submit those questions. The last thing I want to tell you today is blah, blah, blah and it does not relate to teaching you how you can use the cash flow statement to help grow your business.

Okay, so that was the second why. That was the timing, and the cash flow statement does that.

Predict

Now the third reason why you’ve got to start learning how to use the cash flow statement and why it’s so important in business is that it gives you the ability to predict business shortfalls and the surpluses.

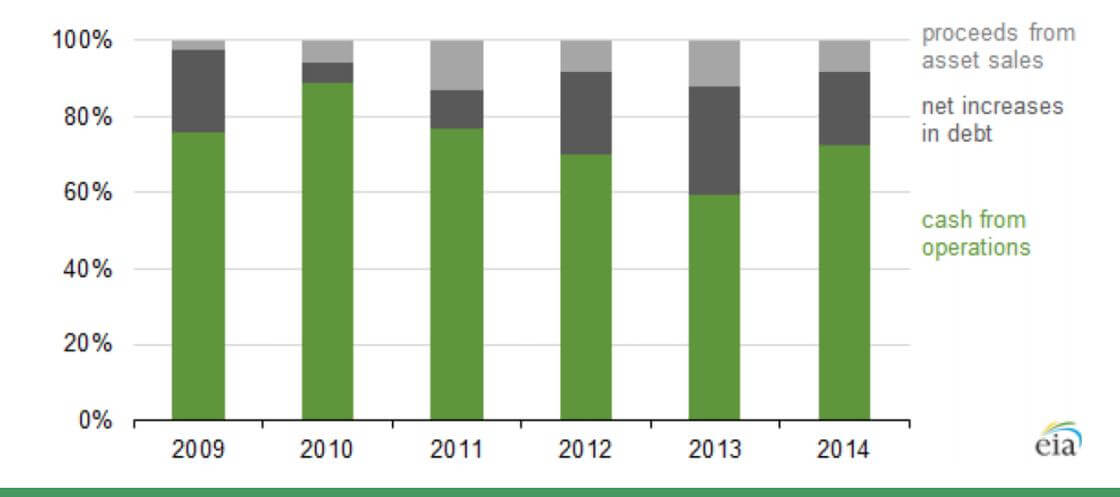

As I mentioned before, we had a client who several years ago opened a restaurant. They had ten investors who invested, let’s say $10K each. So, that would be $100K invested in the restaurant. That was to get paid back within two years. However, the restaurant did so well that the investors got paid back in nine months. Immediately, the investors wanted to open a second restaurant location, and they wanted to give back those funds. So how you get the money out of your business can predict when investors get their money back or predict that you’re going to need money from them to fund payroll, and you need to be able to explain why. So, this is one of my favorite graphs. My favorite slide throughout the whole presentation is this graph because when I look at it, I understand operations.

I see that in 2010 a large percentage, almost 90% of the case used in the business was generated from operations. Then we see that that percentage slowly declined year over year. Those with the green bars show that the rate of cash from operations continued to decrease, but that it’s on the uptake for 2014. The very dark gray sections are net increases in debt. So what that means is they were able to fund the shortfall of cash usage not generated from operations with debt, they took on loans. An investor can see clearly over the last 5 or 6 years of this business how they were able to fund it either with loans or by selling off of fixed assets. That’s the top part of this graph. The light gray area is a fixed asset, and that’s cash in as well. So these three breakdowns are significant to investors when you need money.

How Do You See Yourself 5 Years From Now?

You’ve got to be able to show them and then not only do that and understand the cash flow statement, but that’s when it all begins with the prediction. So what do you want to do in your business for the next two years? Where do you see yourself? How do you see yourself? What about three years, will you have another location? Will all of your investment capital be returned? What about in five years? Do you want to exit the business? Do you want to position it for sale? The cash flow statement, understanding where cash has to come from, and understanding who gets their money back is the five-year cash flow forecast. In that five-year cash flow projection prediction is so important. So point number three is being able to predict what’s going to happen in your business. That’s why you want to understand how to use the cash flow statement.

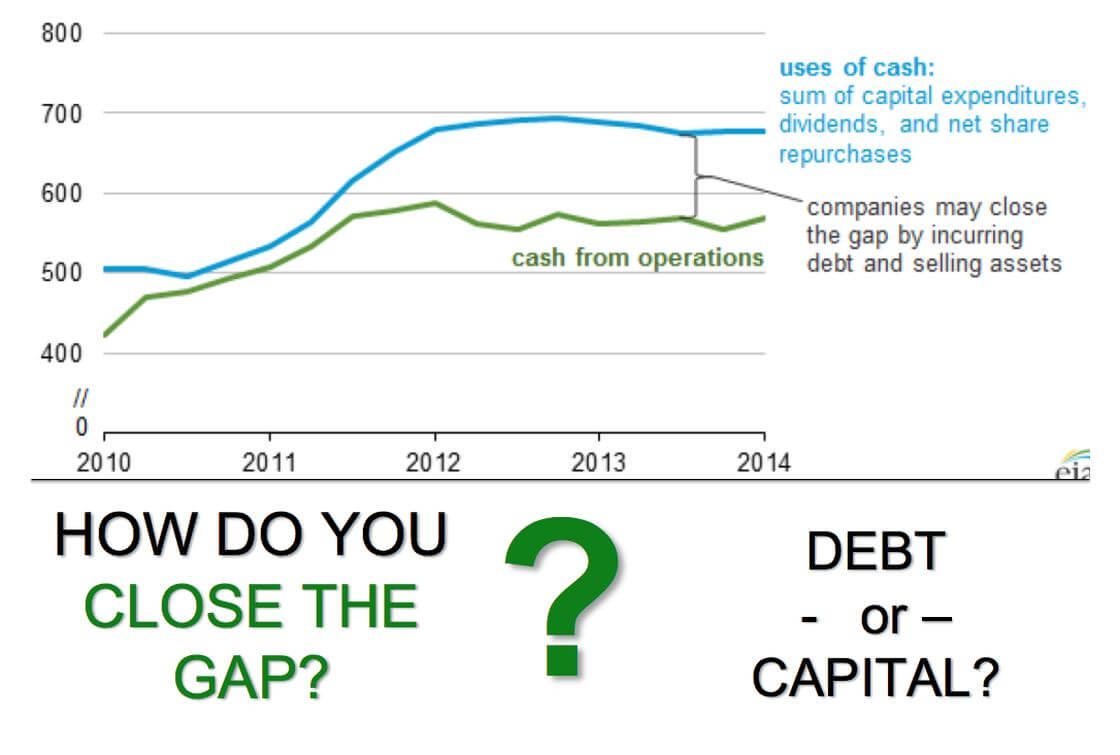

Below is an image of my second favorite graph of the whole webinar slideshow.

The top curve in blue shows how the business is using cash and the bottom curve shows the cash used for operations. The green curve shows there’s a gap in 2014. So, that shows you are predicting a shortfall of cash. We’re going to use more money than we throw off from operations. It looks like they have a budget and like they understand it, but how do you close the gap?

You want to make those decisions. Do you need to gain more debt? Do you need to present it to a bank? Do you need capital? Do you need investments from your investors? This graph helps you make those decisions on covering the gap, so there are no surprises. What do investors hate the most? It’s not only the cash shortfall that’s bad. What’s worse than a cash shortfall is a surprise cash shortfall. Investors hate surprises. Surprising them on a Friday that payroll is due on Monday and they need to write a check for 15k, or you’ll go bankrupt, and your employees won’t get paid, is the worst thing you can do as a restaurant manager.

Restaurant managers and owners, I believe it’s your job to prevent those surprises in cash flow. You need to start with weekly cash flow, make sure you have it month-to-month, understand the cash flow statement almost as well as you do your P&L and your balance sheet. Avoid those surprises so your investors won’t be upset and your spouse won’t be angry when you have to fund the business more as a surprise.

Rules About Cash Flow

Okay, so, there are a couple of rules about cash flow. One is that you could be going up in cash flow and your operations could be doing great.

That will be the two green bars that you see above. However, what happened? Why did it go down and then why did it go down the next year regarding your cash level?

Well, one rule is that growth sucks up cash, and if you’re growing your sales, you’re turning tables more often. Let’s say instead of two table turns, you’ve now got three table turns per night. You are driving table turns, so you’re driving covers. You will probably need more inventory. You may even need more support help related to payroll. What else do you need? Each of those needs requires cash. It sucks it up, especially, if you are adding locations. That also sucks up the growth of the cash.

So, where do you start?

You’ve got to work with your accountant to create a budget. When you have your budget, you’ll know what to expect, and you can make decisions to avoid those surprises and can plan for growth. It also requires accurate accounting records. We don’t ever want to make adjustments as accountants. We don’t want to make changes that disrupt your view of what’s happening in the business. We want you to understand what those adjustments are and that the cash flow statement connects the dots between the P&L and the balance sheet.

So, I encourage you to think like an investor and treat your restaurant as a real business. Make sure it’s still worth what it is that you initially put in it. Now you know the definition of the Third Financial statement. In summary, it’s the cash flow statement, and it only has three sections.

What You Now Know

Ask yourself if you remember the three sections today. The first section is operating, the second section is investing which is fixed assets or equipment, and the third section is financing, where your loans or investor money lands. So what do you do restaurant managers and owners? How do you use it?

You’ve got to make sure that you have a return on your business. You want to make sure that you avoid timing issues that make the P&L or the Balance sheet not show the actual ins and outs of the cash that goes into your business. That will allow you to predict the future, predict where you want to go and be able to plan for it. To be able to know who is going to fund it. Are you going to have to fund it, are your operations going to have to fund it or do you have to get the money from a bank? That puts you in the power position to make sure you are running a healthy business. That’s the importance of thinking like an investor. Make sure that they fully understand and look at the third financial statement, the cash flow statement.

The Bottom Line

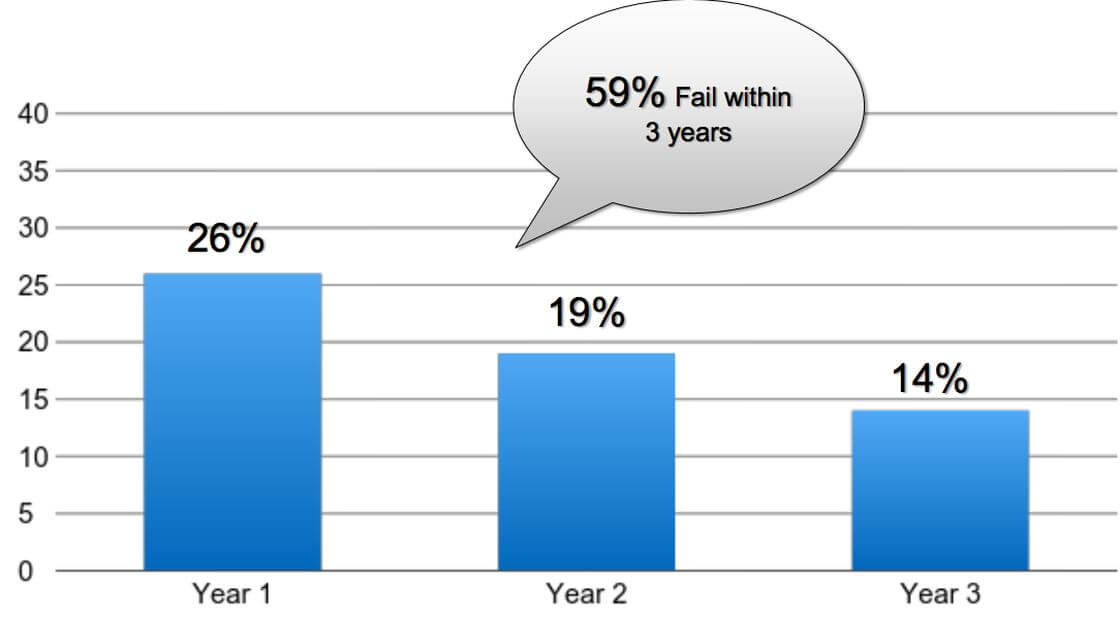

So, the bottom line for today’s webinar is that 59% of restaurants fail in three years. One of the most significant contributing factors is poor cash flow management. It’s causing more business failures today than ever before.

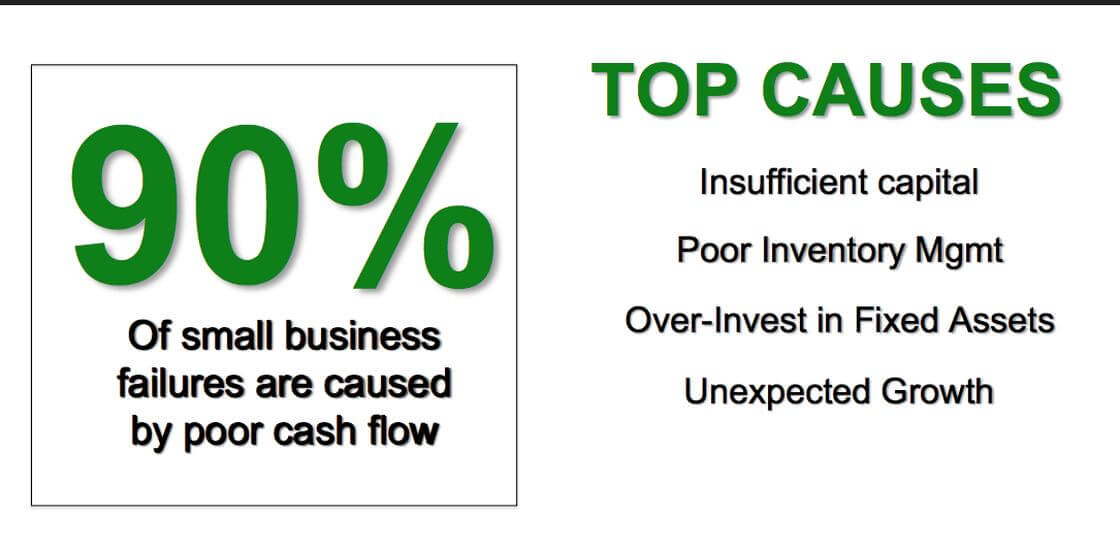

So, you’ve got to be able to overcome the cash flow problem. When I was researching for this webinar, I was shocked that statistics showed that 90% of small business failures are from poor cash flow.

We’ve covered some of the top causes of insufficient funding of capital.

Let’s say you’ve used your life savings to start a restaurant business. Maybe you invested 75K, or perhaps it was 350K. However, it wasn’t sufficient capital for you to have the working capital that your restaurant required. That’s one big reason why cash flow problems exist; it’s that the proper funding does not exist. The cash flow statement helps you overcome that.

Also, poor inventory management is a tremendous issue in the restaurant industry. Everyone always asks, how do we handle inventory? How do we know about food spoilage? Is it using up too much cash? Do I have too much inventory?

Those are the first places to go after cash if you’re running a shortfall is the inventory management. Then, also, if you purchase too many foodstuffs or have too much equipment in your business, those are also top causes of poor cash flow that causes 90% of restaurants to fail.

Then last but not least. I’ve already really pounded home the growth. You can’t grow without cash. Growth, especially unexpected growth, night to night, week over week, or month over month; look at the trend. If you’re growing, you’re probably using up cash. It could be a great problem to have, but make sure it doesn’t throw you into the 90% failure rate of having poor cash flow management.

Think Like An Investor

encourage you to think like an investor, treat your restaurant as a real business, and make sure it always returns what you put into it.

Questions

So, we’ll take just a few minutes to answer your questions. I know that the cash flow statement can be a complex area and discussion topic in restaurants. I’m happy to answer any of your questions.

Okay, so one of the questions we’ve got here is about getting a copy of the slides. Just so that everyone knows, this webinar is being recorded. We record our webinars, and they are available on our website. That is helpful for those who are not using your computer and following along with the slides. That way you can see and hear the recording of Dixie’s topic.

GRA: Is there a common question that you all have regarding the cash flow statement?

Dixie: Yes, the most common question is, I know my business is profitable, and my P & L is positive, but why don’t I have any cash in the bank?

That’s where the cash flow statement connects to the two financial statements, the P & L to the cash, so it shows on the balance sheet. You’ve got to use the cash flow statement to be able to understand why you don’t have cash that you need before you go bankrupt. That’s what probably causes all the disconnect.

For those of you joining us this afternoon, thank you so much for listening. Thank you so much again to Dixie for taking the time to present to our members on this topic.

The follow-up email will have Dixie’s contact information and a way for you to learn more about Trusted CFO Solutions and what they do for their clients every day.

Thank you, everyone.

Tags

Grow Your Restaurant

With our Free Restaurant Success Series

Freely access our restaurant resource center filled with tools, videos, webinars, articles, infographics, and other helpful content to tackle your unique restaurant challenges and grow the business.

What are you waiting for?

Click the button below to learn more.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.