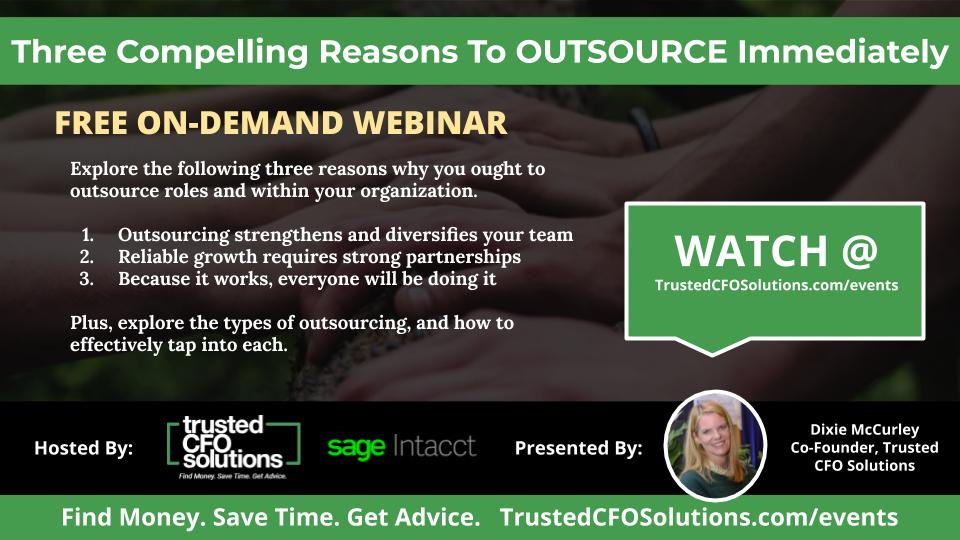

Webinar: Three Compelling Reasons To OUTSOURCE Immediately

Watch this on-demand webinar about why you should be outsourcing selectively or comprehensively.

Webinar Summary

Within the next decade, half the American workforce is expected to be contractors (as opposed to traditional employees) while more people are building their own small companies to serve a variety of organizational problems.

If you’re not yet outsourcing roles and problem solving to individuals and companies, you’re missing out on a key strategic initiative for growing your company.

In this webinar hosted by co-founder Dixie McCurley, she’ll share why you need to be outsourcing, the types of outsourcing, and how to maximize your external resources while harmonizing them with internal operations.

Webcast Agenda

Explore the following three reasons why you ought to outsource roles and within your organization in this on-demand webinar.

- Outsourcing strengthens and diversifies your team

- Reliable growth requires strong technology partnerships

- Because it saves time, everyone will be doing it

Plus, explore the types of outsourcing, and how to effectively tap into each.

Watch This Outsourcing Webinar

Download This Outsourcing Presentation As A PDF

Share This Webinar

Webinar Transcription

Hi, I’m Dixie McCurley with Trusted CFO Solutions. And I’m President and Co-founder. And I’m so happy that you guys have joined me today for the webinar.

Not to toot my own horn, but recently, I won the Financial Leader of the Year Award for innovative solutions. And the reason that I think that I won it is that I believe the best and most successful businesses are innovative and that they change with the times, and they grow with the times. And so right now, if you were to ask me what businesses can do, the number one thing to do would be to outsource. So, let’s talk about three compelling reasons to outsource immediately.

The first one we’re going to talk about is team. The next one, the second reason to outsource is technology and then time, clients– they need their time back. So let’s get started with team. Related to having a team, I think that that is one of the strengths of outsourcing. So, in today’s environment, with technology changing and the way that we handle things and processes, changing people in and out of work, wanting to stay less than two years, sometimes in one business, to have access to a team of specialists without staffing them full time, to me is the biggest part of outsourcing and getting a team at your fingertips. Outsourcing also increases your organizational power. So you’re going to be able to do more than employing internal people. And also when you’ve reached capacity to do it yourself, either with technology, your people, or your processes and you don’t really know where to go. We want to be able to help from a team approach, help you continue to run the performance of your business. And so, having a team and professional team in that, that’s capable of flexing along with the business, it’s a lot easier to start than you think. And so that’s the biggest part about team and outsourcing is that you get a team at your fingertips. So some of the collaborative roles and responsibilities that you need, usually within your accounting and finance department, you might need a sliver of a CFO, but also in terms of like you need a payroll, maybe an in house person, or you think that you need someone to run your payroll all the time. We see also that technology, there are so many users in a collaborative type of environment that you need system administrators on staff. And what are the audit logs, who has access those types of things and I think business owners are very challenged to this to design the right set of systems that are going to work for them. And so having a team of a staff accountant if you need it or a senior accountant if you needed or controller; that’s what outsourcing really does is to help have a collaborative team to shift workload. And so my job on a daily basis is to run our Trusted CFO Solutions outsource team. And there are times where the staff accountant may have a question that needs to go to the CFO. And there are times with a quote; the CFO has questions about how the process works. And so we create systems inside of our team that allows us to shift that to the person that has the most knowledge about how to do it, so you get a higher level of expertise and all of those reasons why to have a team.

Now there are lots of different types of outsourcing. And so I think that the most prevalent one is the one over on the right, which is the selective part of it. And so selective means that you can outsource some of it, a little bit of it, or all of it. And when we want to outsource all of it, that’s really that comprehensive take. And so we outsource the entire accounting and finance department for a lot of our clients. And so we take a comprehensive approach. But that doesn’t mean that we don’t start with clients on the selective side. So, if you’re a business and you’re looking to innovate, and I’m saying today that outsourcing is the number one way that businesses can be innovative, maybe you start with selective outsourcing. Now, a lot of companies and a lot of firms do contracting, and they might bill you by the hour for one person. But that’s still a staffing model. And it’s not necessarily this outsourced BPO model; you might just be outsourcing tasks. In addition, we’re really the experts as you outsource to us on what you need licenses to. So, who on your team gets to access systems, who on your team needs a license to be able to do processes? Let’s take review of a journal entry. If we’re doing the entry and you’re reviewing it, you might need a license to do that. And so we treat our company as a BPO model, which is the Business process Outsourcing model, to allow you to have a team, to be able to outsource to, to be innovative in your business so that you can focus on growing your business, and being successful in your business. So those are the four types of outsourcing that we see. Our goal is to be the comprehensive outsourcing, but also the selective piece that really gets us started. So over time, we’ll see that change.

Now, the second most compelling reason why to outsource immediately is technology. We know right now that technology is moving at a pace that is unparalleled, especially to anything that I’ve seen in my career. My experience is that technology used to be reactive. It used to be on-premise, you had to send everything into an accounting and finance department. They would use their technology; they would create reports out of it, they would send it out. So, it was highly reactive to like the winds and waves of circumstance. And so today with digital technology and the cloud and creating collaborative things, you don’t want to pay for all the technology solutions that you need to run a proper accounting and finance department. So the second most compelling reason is that you get cutting edge technology without having to buy it yourself and pay for it yourself. And so firms like us that are having the technology solution, along with the team solution, we’re going to be a greater value to you, than you doing it all yourself; hiring an internal team and putting in your same technology. And my point from earlier that technology is changing so swiftly today. In addition to that, operational systems that usually live outside of the general ledger, those are now being tied into the technology solutions to create a collaborative accounting and finance department. So we’re tying in operational metrics to accounting and finance that used to you weren’t even able to do, or it would cost you a lot of money. And you need people who are trained to be able to do that. So, in terms of should you hire an on-site staff, they may not have the tools and experience levels to be able to run those types of things to give you the insight and give you the guidance that’s going to be able to help elevate and scale your business.

So, the number two most compelling reason is that you get more technology than you have to pay for if you do it inside. Related to technology and shifts from what’s been happening over the last few years. If you were to look fifteen years ago, I don’t think that we would have the same response to employees working remotely from home. Today it’s a no brainer. Companies that are winning Best Places to Work, they have to have a remote policy in place that says, you know, today, one day a week our employees get to work from home. So the digital technology is enabling people to not have to work physically on site. And so that part’s no brainer. What I’m saying today is that outsourcing is also a no-brainer, that if you’re not outsourcing your accounting and finance department, then you’re almost ten years behind some of your top competitors who have been outsourcing for years. So, I want you to think about how payroll moved over the years. Payroll is one of those things that is a no-brainer to outsource. The payroll company keeps up with all the regulations, the rules, and business owners don’t want to keep up with those things. They want to outsource it to their payroll providers who are the experts at that. And that’s what I’m saying about the accounting and finance department. It is now a no brainer to think about, like employees working remotely from home, it’s a no-brainer to outsource your accounting and finance department to a firm that specializes in that.

So we’ll take those two things, the team, and also the technology. And I want to talk about how to combine that. So, what we have in the middle is our finance department and our accounting department. And large companies, the one especially growing from medium to large, they are doing things like comprehensive outsourcing, and that means they have a complex business, they’re using an entire third party and doing comprehensive outsourcing. But the small business can start with the smaller orange circle to do selective insourcing or selective outsourcing as they grow. So maybe you only need a part-time person and you have those insourcing. But as you become more complex and your demands go up in your business, you’re going to want to take that immediately, be innovative with it and move towards outsourcing. So we see each of these accounting and finance departments going up the chain in terms of level of complexity, and also moving from internal to a third party and outsourcing. Now how those two things connect is going to be with the people. And the people who know how to run the systems, know how to process, know how to connect things, is a lot more than just, you know, setting up a system and doing the same thing over and over again. We have seen that the releases from some of these amazing technology systems are outpacing things, moving it forward years and years, light years ahead. And so how you run your accounting department, if you run an in house, it’s really hard to get your people trained. And so we are taking the approach that training has to be at least 20% of all of our jobs at Trusted CFO Solutions, because in six months, the thing that we’re using for automated payables or the thing that we’re using for expense management, those things are new systems are coming out, is replacing the functionality, those would put us light years ahead. But we’ve got to research it, we’ve got to train on it, we’ve got to certify on it, and make sure that it’s the right solution for our client. So we are segregating that into System Administration. So on the right, in terms of like let’s customize, let’s integrate for our clients, let’s extend the usability of the systems into other areas; we’ve got to have the system administrators and system designers on staff that normally you can’t have in your business, it’s just too expensive. But to outsource that to us is what we’re talking about in terms of creating your modern financial outsourcing platform. And so, using the technology for that, you have to be an expert in master data structures. You have to know if you need to add a new department versus a new class, versus a new chart of accounts because we’re trying to create a standard template. And when you outsource to a business process outsourcer like us, we already have all the standard templates that it takes to get the chart of accounts right. So we move all of our clients into a standard process, because even if they don’t need something today like maybe they don’t need a cash flow forecast today, maybe they don’t need any financial analysis today, we know that business is becoming more and more demanding that you’re going to need it one day. And so if you set up the foundation and the infrastructure properly, from an expert level, then you can always continue to grow, always continue to be successful in your business. And the best businesses are the innovative ones, where they’re using the system to more of a customized to them in terms of getting your technology right, without having to pay the enormous cost for it. I talk a lot about my experience ten years ago and fifteen years ago. And I think today, the technology has come so far, that something that might cost you $5K to $10K to $15K to implement today, it would have taken $2M fifteen years ago. So there’s been a big leap in technology. And each every six months, it becomes more and more and more. So technology, having your partners who are integrated with you, having partners who know about the technology or train employees to take advantage of all of those things–that’s where businesses are going to succeed. So we’ve covered the first compelling reason and also the second. The first one is team and the second one is technology.

The third one we want to talk about is time. Related to what you’re spending your time on, how time-consuming is it to manage the accounting and finance functions. How time-consuming is it to manage the technology function? So it’s not only the cost of a team and the costs of the technology, but it’s also the amount of time that it takes from business owners. And so, clients over the years, year after year after year, the number one thing that they say is they need their time back. And the peace of mind that they get by outsourcing to an expert who knows how to build an outsourced accounting and finance department is one of the things that our clients say the most of is that we need our time back so that they can manage the things that are core to their business, and focus on what’s driving revenue, and also what they’re passionate about. So used to, ten years ago, fifteen years ago, clients had to worry about where their numbers right. They had to make sure that, you know, it was structured the way that they ran their business today, that can easily be outsourced that they don’t have to spend the time on the administrative function, and instead spend the time on things that are driving their business. Now I think lots of people over the years, especially ten or fifteen years, they’ve tried outsourcing, and they may not have had a good experience. And so I still hear war stories today. But just like the original iPhone all those years ago, it didn’t do everything that the phone today does. The same thing is true about outsourcing. Technology’s changed our training on technology, the way that we process in an outsource way is completely different than it was five years ago. And so we think that accounting and finance is going to be the top function that’s outsourced by 2025.

We’ve been in business since 2011. And so if you think about all those years that all we’ve been doing is outsourcing accounting and finance departments for businesses to help drive the performance of their business, we’re getting really good at that. And so we’re lightyears ahead, and I think ten years ahead of the companies that are trying to build it internally. And so we’re here to enable and empower the people that are internal at our clients, and us to be the expert team to help guide and solidify the company’s success. So if you’ve grown from a mom and pop stage of a business, and you’re looking to grow to a medium-sized business or a large small business, the most innovative thing that you can do right now is build a team in outsourcing. And so there’s a lot of reasons why to stop thinking about outsourcing the way that we used to do it. It’s a new environment today. And I want to be able to help you guys get your time back. So that’s the third reason why, the compelling reason of why to outsource is to get your time back. So you’re faced with a decision in terms of outsourcing to build or not to build. And do you really want to build your own accounting and finance department when you’ve got access to the experts to do it? So I like this picture a lot. I think about building a barn today with technology. So, you know, today you can build it with the right insulation in it. You can build it with the right materials, but things keep changing. So imagine that you built a barn today, but the way that technology is changing, in a few years or next year, you need a completely different set of specs on what it looks like. So do you want to rebuild it all again, for how your technology is going to change your business? We see that the Uber model of business and how it disrupts all industries, all industries are being disrupted today. And so if you’re going to build something that does isn’t that changeable, and isn’t that flexible, to be able to grow as your business grows, that’s what we’re seeing that companies are being left behind. So the most innovative businesses, how they’re successful and how they grow is they outsource, they don’t try to do it yourself or build it that way.

So, on the last part of our webinar, I want to share some success stories of how some of our clients have been able to successfully outsource to us as a team. And so, related to some client interviews that we’ve had, for a number one a team is that a lot of our clients say that we understand what it is that they’re asking for. I believe that our clients cannot do the work that they have to do every day, and also be the innovative tool to come in to change what they’re doing. And so by working with us as a team, by having a team of experts in terms of financial analysts or our CFO, being able to restructure reports from a system administration function, being able to look at the processes and make bank rec’s faster. We helped Debbie in thus situation save 40 hours at month end close by doing intercompany accounting with a better technology system. And so it’s so hard to learn the things that we know for people who are internal and clients tt takes years to learn the software, the technology, the new things. How do we add in accounts payable? Automation? How do we add in a payroll connectivity? How do we add in slice and dice capability with interactive custom reports, all of those things? You could spend a year just training on what would be the best CRP. Instead, you want to add a team. So the number one compelling reason why to outsource is that you get a team of experts at your fingertips.

We have a client also who has used QuickBooks for years and between the two different locations that they had, it never worked right for the reports, for how the cash drawers worked, etc. So we were able to add in new technology for them, and they were able to see their daily sales numbers as they come into budget. So what are average daily sales was the major question that they couldn’t get from QuickBooks. And also to be able to set a budget per day, so that all of their staff, their production staff, knew exactly what goals they were trying to make if they were 75% of the way there, etc. So, to use technology, in a new way, to not have to have it internal for someone to be the expert. This company has now shifted change four or five different times from the technology solutions of processing payments, what their e-commerce cart looks like, their point of sale we’re about to replace because one of the old methods used to be called Shopkeep. But we’re looking at new options for how they can continue to interact, and we can build a better accounting and finance department for them to get the reports that they need so that customers are happier. So the plug and play ability of technology really requires a team of experts and technology to be able to help guide them on what’s the best solution. And so, if they were to build that internally, it would cost them a lot more, and they wouldn’t save as much time.

My third case study to share with you is related to the fact that we give our clients their time back to focus on what’s the most critical to increase their business profitability. And so, when you’re not having to manage an accounting and finance function, and you’re not having to hire new people when you lose other people, and when you work with a team of professionals with the right technology, you’re going to be able to get your time back. And as you get your time back, you can really look at and analyze those things that are making a difference. And so for me, having your time back is where you get to strategize, what’s the best course of that avenue for us in the future? And if you’re going to look to the future, that’s the part about being innovative; what do we need to do today in our business to enhance this performance? When you ask yourself those questions instead of should I hire this person? Should I have the bank reconciled to take all those things off? When you get your time back, you’re able to run a better business. And so, related to having your time back, you’re going to let your numbers tell the story of your business to everyone involved without you having to create and craft it.

Now, if you don’t believe me, from what I’ve said so far, in terms of innovative businesses are doing outsourcing. I want to share with you this study that was done by Microsoft, and it’s called the Watershed Study. And in it, it said by 2025, the outsourcing market is going to be a $343 billion industry. And they stated that the top five outsource services, number one, you’ll see is financial and accounting functions. And so the trend has already started. We’re in 2020. And in five years, all professional services like human resources, knowledge processing, and outsourcing, procurement, and supply chain and also customer services. It’s astonishing to me that the number one right there is financial accounting functions. And so, we have built a company to be able to do the business processing outsourcing so that clients can outsource to us to number one, have a team of experts. And number two, have greater technology than they have by themselves, and then also so that they can get their time back. And so this is just the evidence, again, about the trend of where we’ve been over the last ten years and where we’re going in the next five years.

That today are the three compelling reasons why to outsource immediately. And so, thank you guys for joining me.

Three Compelling Reasons to Outsource Infographic

Additional Resources

Tags

Grow Your Restaurant

With our Free Restaurant Success Series

Freely access our restaurant resource center filled with tools, videos, webinars, articles, infographics, and other helpful content to tackle your unique restaurant challenges and grow the business.

What are you waiting for?

Click the button below to learn more.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.