How Failing Bank Compliance Can Stunt Your Restaurant (or Franchise) Growth and What to Do

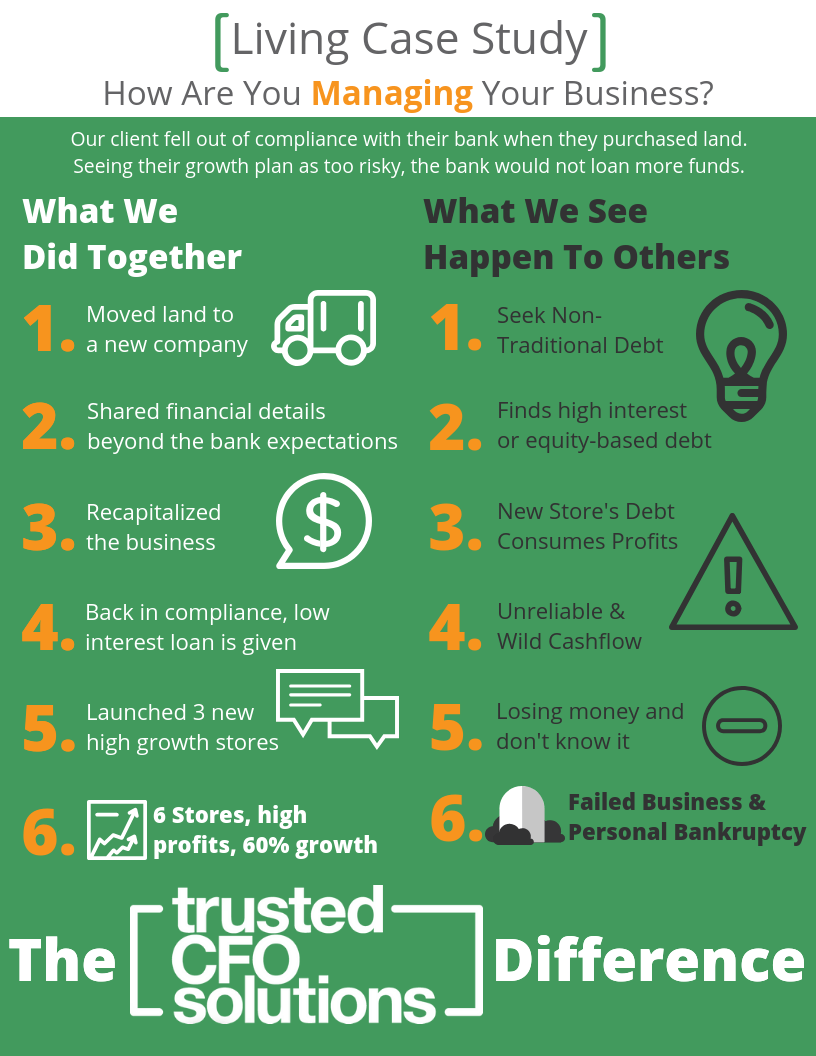

In 2016, a restaurant client with three locations elected to purchase the real estate for each site. The moment they got a new loan and closed the purchase, it propelled them out of compliance with their bank covenants. At that point, they learned the banks would no longer loan them money to build the next three stores planned for the following year.

This client was approved by the franchisor to build three new stores, which equated to sixty percent growth. However, when a bank sees a company with a projection of sixty percent growth, they see the investment as too risky and run the other way.

We put together a financial forecasting model to show the impact of just one of the stores, and how recapitalizing it for the banks at even a higher rate with mezzanine debt, instead of the traditional one, so they could have high growth for all three stores the following year.

They weren’t able to shop the banks to show their years of compliance with bank covenants or to separate the companies of the real estate.

We took his financial information and created different scenarios with the real estate and without the real estate. At first glance, it appeared they weren’t in covenant compliance. We created a one-page executive summary so the banks could see the impact of each additional new store, and it put them in compliance.

We helped them recapitalize the business by moving the real estate out, placing them back into covenant compliance and they got the money.

Without Trusted CFO Solutions The Owner Would Not Gain Approval To Finance The New Stores

Without Trusted CFO Solutions, our client would have to search for alternative methods. Usually, when going that route, the owner has to give away a large portion of equity.

For example, instead of client acquiring a six percent bank loan, most investors will want twelve or twenty percent. It’s also possible that an investor will want an equity share in the company instead of only providing a loan. It is far more costly when you don’t use funding sources from a traditional franchisee situation.

When you are in a high growth mode, you usually have to pay much more for that risky growth. The question from the investor becomes, what if the store doesn’t perform?

Working together, we make comparisons on all the stores, look at the histories and diligently show the timeline of adding each one.

Where Does This High Risk Leave An Owner?

Quicker than most realize, you can have a profitable business shift into a non-profitable one. When the profitable stores are left to sustain the non-profitable locations, all the resources can be drained. It’s a difference in profits of $250K versus $1M. Especially when you start in those levels of multiples.

What the business throws out from the cash flow each year can swing wildly without these comparisons. You could be losing money and not know it because of the interest expense.

If the business fails, the owner will likely be forced to file personal bankruptcy due to personal guarantees on loans. They fall out of compliance in their business and lose their home and all their other possessions. We see this scenario all the time with restaurants.

What Can An Owner Do?

It takes an expert like Trusted CFO Solutions to manage this level of growth.

Less than five percent of CFO’s know how to manage debt structure and capitalization of businesses so they will comply. On our website, there is data from insight to action, but most people stop at information. Most CFO’s and accountants give the financials to the bank. The banks come back with the answer that the business is not in compliance with bank covenants. The loan is declined and growth is stunted.

The team at Trusted CFO Solutions knows the complexity of the bank covenants. We understand the formulas they create in terms of the current portion, the equity portion, and the net worth of the business. We give the bank structured financials that allow them to go; “WOW, this is a better analysis than we did!” Moreover, the bank says yes to the business growing sixty percent over the next year instead of saying no.

This process helped our client restore covenant compliance with the bank and opened the door for growth! It can do the same for you and your business as well.

Click here to learn more about working together.

High-Growth Businesses Choose Sage Intacct

Tags

Outgrowing Quickbooks?

Say goodbye to spreadsheet reporting and manual consolidations and start using a cloud-based financial management system.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.