For Finance Experts: Do You Know The Number One Reason Clients Leave Their CPA?

The Financial Services Expertise Series: This training article is for CPA professionals.

As a restaurant owner, CEO or Manager, can you guess what the number one reason clients in our 2016 survey said they left their CPA firm?

At the 2016 AICPA Tech Workshop, we solicited our participants to guess the reason they believe clients leave. Below are their responses.

- Lack of Responsiveness

- Poor Culture

- Perceived Indifference

- No Proactive Advice

Which one of the four responses do you think is the number one reason clients left their CPA firm? If you chose No Proactive Advice, you are right! It was not any of the other three or the price, often a mentioned response. When a client does not receive proactive advice, they grow tired of looking in the rearview mirror, especially when it comes to their accounting.

Photo by Kalle Kortelainen on Unsplash

Photo by Kalle Kortelainen on Unsplash

What’s The Big Disconnect?

The disconnect is the technology that we use for a compliance-based service, and what we communicate with our clients about client accounting services. There are others in the industry that recognize this gap. Non-traditional competition is looking at ways to provide this service. The reason SSARS 21 (Statement of Standards for Accounting and Review Services) originated is so firms could play in this space in a healthy way. Technology providers know this too, and they are looking at ways to be disruptive. If you are not bridging the gap, then disruption does not become an opportunity, it becomes a real threat.

What are Specific Ways Technology Will Help Accomplish Better Approaches?

Relevant Dashboards

Our survey clients asked for our dashboards. Dashboards are a great way to aggregate the data that is important to your client (not what is important to you as the financial expert). Find out what is important to them and put together a dashboard report. Advise them on what some of those things are and present them in an insightful way with easy to understand terms.

The above image is not a dashboard of a balance sheet or an income statement and expense report. These are what Sage Intacct calls performance cards, and they provide clear simple information. If green arrows are going up, it is probably a good thing. If the expense arrow is going up, it is going to be red because that is a bad thing. These are simple to understand ways you can communicate the knowledge you are getting from that information. It is not just taking data and converting it into information. It is now using that information to share knowledge in a real way with your clients.

Photo by Daniel Tafjord on Unsplash

Photo by Daniel Tafjord on Unsplash

Anticipating Client Pain Points

The other customer request involved anticipating our client pain points.

Daniel Burris is a futurist. He wrote a book titled the Anticipatory Organization. He talks in his book about this idea of hard trends, things we know are absolutes. We know demographics are changing, we know technology is advancing, and we see the environment we are operating in is becoming more complex. Would you argue any of those three things? When everyone agrees, this is what Burris calls hard trends.

There are soft trends as well. These are the things that may or may not happen to surround the hard trends. He talks about this competency around anticipation and the idea that if you know the hard trend, and you are an expert in your vertical or your business, you can begin to anticipate certain soft trends that are going to happen. This empowers you to anticipate the needs of your clients.

It is easy to communicate with a client, it is easy to ask the right questions, it is easy to provide the right service. It is easy to bridge that gap and understand what clients are asking for and where you need to change your offering.

Technology Leverage From Trends

For example, we know technology is advanced. It’s expensive to pay a bill of $65.00 for a small business. Since there is technology available to help our clients pay this bill better, we want to reduce the cost of available technology. There are two ways this happens.

1 – Clients will go to the software vendor, or they will go to their bank bill pay. They will find a way to do it better. They may or may not implement it correctly, and they may or may not have the right segregation of duties.

Or

2 – You can anticipate they are going to do that because you know what’s happening, and you can go out and find the technology and communicate you can help them do that more efficiently. You can help your expecting clients do it and reduce the cost.

That is how you take disruption and innovate around it rather than become dis-intermediated. It is the acknowledgment of where to be thinking and what to be talking about. Anticipate the problems that will happen.

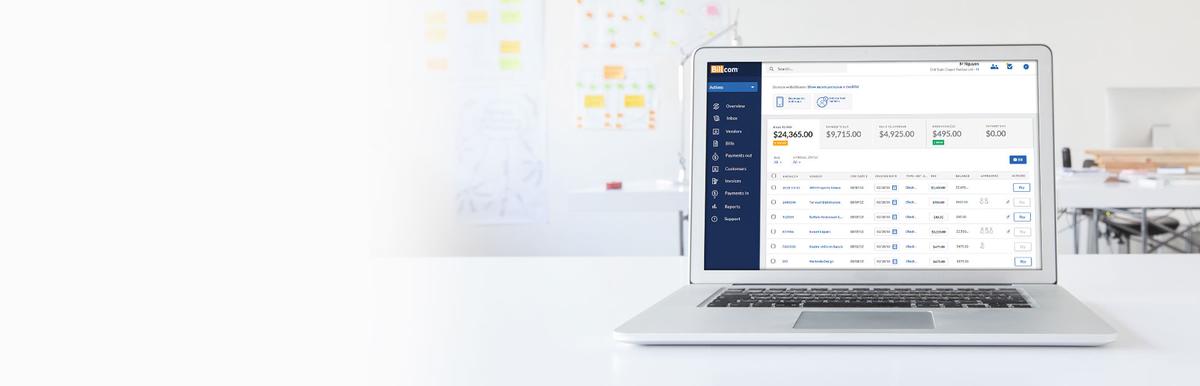

Example: Bill.com Empowers Companies

During our workshop, the question arose, “Do you have an estimate of the cost of a $65.00 invoice where there is still a human involved?”

Through Bill.com, we can look at the hidden costs of doing it manually. Our average client saves between $10K-$12K per year by automating the process. There are so many other soft costs that we do not realize, we are safe stating it is higher.

The comparable in a transaction to transaction depends on your industry, and it depends on the cost of the people performing the task. At our firm, our software is much like our payroll provider software or the software we use for a tax return. We do not line item those or the Bill.com costs to our customers. We count the number of transactions up front to find out how much it will cost us to process. Then we do a fixed fee bundled technology cost that is included with their monthly fee. That way that they need not worry about the number of transactions and us charging them per transactions.

Accountants love to share the numbers and the costs with the clients. The clients don’t necessarily care about that if it is included in a bundle.

Some firms do a study on their own as well regarding quantifying this, so they look at the capacity of someone who is paying bills, how many bills they are paying, and the clients they are serving. However, you have to have a body of work to be able to come up with some of those numbers.

Using variable cost reduces your level of flexibility. Bill.com is coming out with so many new initiatives related to their technology that you can get it processed for a nominal fee per transaction. I do not want to talk to the client about, “Okay, every one of your transactions used to be 95 cents per transaction, and now without any manual work it costs us 1.25 per transaction”. We’re not here to nickel and dime our clients. We want to take advantage of the technology that allows us to service what slice of analytics they need from our expertise.

You may still have to raise the fee, but you don’t need to discuss in detail. Some folks bill a monthly retainer and are not interested in charging their clients for the line item fees. This is much like clients don’t see a line item fee for tax return preparation software when they pay for their tax return.

The practical management takeaway here is phenomenal. Leverage the technology as part of your service offering, and make it easy for clients to process the financial aspect. Don’t talk about things not important to our customers, and instead offer proactive advice, provide dashboards and anticipate their pain points.

In our next Financial Expert Series blog article, we’ll talk about rethinking client communication and three things that clients really want.

Tags

Outgrowing Quickbooks?

Say goodbye to spreadsheet reporting and manual consolidations and start using a cloud-based financial management system.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.